Tax Credit for Employer-Provided Child Care Facilities and Services

How does offering child care as an employee benefit help my business, and how can I get money back at tax time?

Introduction

We know that access to quality child care is vitally important to all types of businesses. Child care is necessary for a parent to get to work, and to keep their job. The economic impacts of child care are clear – while at the same time, a lack of child care has negative impacts on employees and employers alike, through lost productivity to an employee leaving work all together.

In today’s staffing crunch, offering child care is more important than ever for employers who want to attract and retain the best talent, including employees with young children. Businesses that offer a child care benefit see many positive outcomes, including increases in employee productivity, engagement, trust, autonomy, and empowerment.

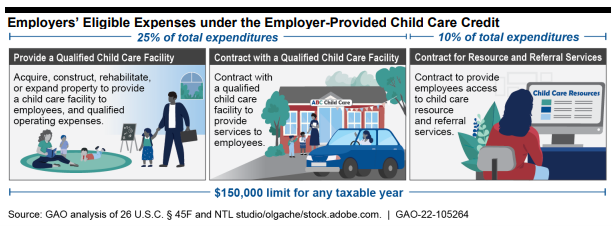

For 20 years, the federal government has offered a tax credit to encourage businesses to offer child care benefits to their employees. The Employer-Provided Child Care Facilities and Services credit allows businesses to receive a valuable tax credit of 25% of related child care expenses and 10% of their resource and referral expenses, up to a total of $150,000.

Rules and Restrictions

There are three ways which employers can offer child care services that qualify for the Employer-Provided Child Care Facilities and Services credit:

- Providing On-Site Care for Employees. This includes expenses to acquire, construct, rehabilitate, or expand a property to provide child care to employees, as well as qualified operating expenses for such child care services.

- Contract with a Child Care Program: Expenses in this category include those needed to contract with a qualified child care facility that will provide child care services to the children of employees.

- Contracting for Research and Referral: This includes costs to contract with an entity who will provide research and referral services, to help employees find child care.

If the employer seeks to receive a tax credit for offering child care as an employee benefit, enrollment in the child care program must be open to all employees and cannot favor any group of employees, such as those who are highly compensated.

If a child care business seeks to claim this tax credit for service offered to its own employees, then at least 30% of enrolled children must be employees’ dependents. For example, if your child care program has 20 enrolled children, at least six children (30%) must be dependents of your employees for your business to be eligible to claim the credit.

Claiming Your Credit

The Employer-Provided Child Care Facilities and Services credit offers 25% of child care expenses plus 10% of resource and referral expenditures, up to $150,000 per year, back to you when you file your business taxes. The credit, which is generally reported as part of the general business credit, can offset actual federal income tax liability and is not refundable in the current tax year; it reduces the amount of taxes owed by the employer.

Businesses can claim the credit on IRS Form 8882, which is simple and straightforward. Employers can claim the total amount of qualified child care expenditures, which includes operating expenses of a facility, regardless of the facility’s location (in-house or off-site) or whether it is run by another contracted entity. Moreover, businesses should include costs for operating the facility, if applicable, including training child care employees and paying such employees.

Costs related to constructing, expanding, or rehabilitating a property that is used for the child care facility can also be included, but only when facilities are located at a site other than the principal residence of the taxpayer seeking to claim the benefit. Businesses seeking to offer child care to their employees and claim this credit should not be impacted by this provision, as it would most likely impact home-based child care programs seeking to receive this credit.

It is important to note that the total of the expenses included cannot exceed the fair market value of the child care facility.

In summary, if you have an on-site facility or a contract with an off-site facility to provide child care services to your employees, you can recoup up to 25% of your expenditures as a tax credit, with an upper limit of $150,000. If you're providing resource and referral services, you recoup up to 10% of those costs as a tax credit, built into the same credit limit. These funds are provided as a tax credit for the business taxes you owe. If you file as an S corporation or a partnership, this deduction goes right on your Schedule K and flows onto your personal tax return.

Let’s consider examples of how two employers calculated their total qualified expenses.

- Example 1: Gidgets & Gizmos Corporation has a $50,000 annual contract with Happy Apple Child Care, an off-site child care program. Total qualified expenses for the Corporation will amount to the total incurred cost of their contract with Happy Apple Child Care: $50,000.

Additionally, Gidgets & Gizmos contracts with a local Child Care Resource & Referral agency (CCR&R) to connect employees to other options for child care programs in addition to Happy Apple Child Care. The Corporation’s annual contract with their local CCR&R is $10,000.

Gidgets & Gizmos incurred $50,000 in qualified child care services expenses, the business would receive a tax credit of up to $12,500. ($50,000 x 0.25 = $12,500)

Additionally, since 10% of resource and referral expenditures can be claimed, Gidgets & Gizmos can claim $1,000 ($10,000 x 0.1 = $1,000) as a tax credit for their CCR&R contract.

In total, Gidgets & Gizmos can claim $13,500 as an annual tax credit.

- Example 2: Goodman LLC contracts with child care provider Little Learners to offer child care services at the Goodman LLC office building. Total qualified expenses for Goodman LLC can include costs of the on-site facility and the total incurred cost of Goodman LLC contract with Little Learners.

Where can I learn more?

You can learn more about Form 8882, Credit for Employer-Provided Child Care Facilities and Services on the IRS website.

This explainer is not meant to provide tax, legal, or accounting advise. Please consult with your attorney or tax preparer for more information and guidance pertaining to your particular circumstances.