Maximizing your tax deductions: employing your child

Learn how you could maximize your tax deductions during tax time by employing your child.

The advantage of employing your child

Many providers currently employ their own children under the age of 18 to help with their workload. Sometimes, they might give gifts instead of paying them, but gifts aren't a business expense you can deduct. If you pay your children, you might think you have to employ them as contractors or do it "off the books. The truth is, it’s simple to do it legally! If you do it the right way, it becomes deductible so you don’t have to pay payroll taxes on it. It’s more than just tax savings, too. You're shifting income from your business, which would normally be taxed at your business rate, to your child, who might pay very little or no taxes.

Let’s first consider an example: Teresa is a sole proprietor who is in the 22% tax bracket. She pays her child $10,000 a year to help after school and on weekends. Right now, she pays her off the books and must pay $3,730 in extra taxes that she would not have to pay, if done legally.

You’re spending money on your children either way, so why not get a deduction on it in the process?

Understanding how it works

Before we get into how exactly you employ your child, it helps if we look further into what it is you would be doing.

You're taking income taxed at your rate and shifting it to be taxed at your child’s tax rate. Your child can claim the standard deduction— the amount of income everyone can earn tax-free (the 2023 Standard Deduction is $13,850). You get a business reduction by removing taxable income from your business and giving it to your child, who doesn’t have to pay taxes on it (if the amount you pay them is at or below the standard deduction). As a bonus, if your business isn't taxed as a corporation (like a sole proprietorship) and your child is under 18, you don't have to pay FICA, Medicare, or federal unemployment taxes on their wages.

A step-by-step guide to employing your child

It’s fairly easy to do if your business is a sole proprietorship or single member LLC. It gets a little more complicated for S Corporations, but we'll discuss that in further down.

Step 1: Prepare a job description that describes the responsibilities of your child’s job. Some examples include playing with the children, cleaning up before and after the children, preparing meals for the children, cleaning toys, and basic record-keeping. Don't include personal activities such as shopping, mowing the lawn, running family errands, etc. Don't count any work for activities that would still be done if you weren't in business.

Pro Tip: You'll need an Employer Identification Number (EIN), even if you’re a sole proprietor. If you don’t' already have an EIN, you can visit the IRS’ website to apply for one. As a bonus, having an EIN can help protect your information when you need to give it out. By using and EIN instead of your Social Security Number, you reduce the risk of identity theft. Using an EIN during online business transactions and tax-related activities involves security measures not normally required when using personal identification.

Step 2: Prepare a written agreement between you and your child that describes their job, days and hours, pay, etc. Both parties should sign this agreement.

Step 3: Keep a daily record of when the work was done (Monday 9am - 10am, Tuesday 9am - 10am, Wednesday 9am - 10am, etc.). You could even take some pictures or videos of your kid working for more documentation!

Step 4: Maintain proof of payment. If you pay your child in cash, have a system in place to log those payments, just like you would with any other receipt. Alternatively, there are many other systems you could use for verifiable payments, including an ACH or a check.

Whichever system you choose, be sure that the wages are paid into an account in the child’s name. You cannot transfer it into your personal account and claim you’re paying them.

Pro Tip: What you pay must be a reasonable wage for reasonable work. For example, you could not hire your child to do dishes or pay them $300 an hour to file paperwork.

Considerations for S Corporations

If you pay your child directly from an S Corp, you have to treat them like normal employees. This means paying FICA and Federal Unemployment taxes. The good news is, there’s still a way maximize your deductions!

Step 1: Set up a separate Sole Proprietorship or Single Member LLC.

Step 2: Have your S Corp contract with the new company you set up. This way, the new company you set up can pay your children.

For example, say you want to pay your child to file paperwork. First, set up a sole proprietorship or LLC (these are sometimes called family management companies). We’ll call it XYZ Family Management Company. This company can now contract with your S Corp for file management services.

Your S Corp pays XYZ Family Management and XYZ Family Management pays for your child. This moves your child’s payment into a company that isn't a corporation, so you don't have to withhold FICA and federal unemployment taxes.

If you set up a family management company, make sure you have documentation. With our example, XYZ Family Management Company would send invoices to the S Corp, and the S Corp is sending 1099s to XYZ.

Pro Tip: Grandchildren, nieces, nephews, etc. work the same way, but the parent of the child being paid must be the one to set up the subcontractor company.

Reporting on your taxes

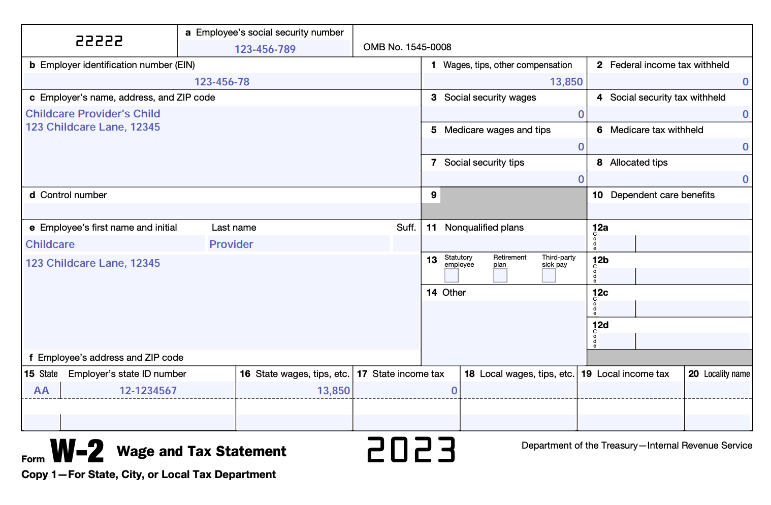

Remember, you don’t have to pay taxes, so filling out a W2 is a good formality for good record-keeping.

Your child’s W2 will look similar to the one below:

The main idea is when you pay your child, the payment comes out of the business. This makes it a deduction because it is payroll, but then it goes to your child and if kept under the standard deduction for the year, you don’t pay taxes on it.

Final Considerations

A couple other things to keep in mind while you go through this process:

- You don't have to pay your child the federal minimum wage of $7.25 per hour. However, you should check with your state’s department of labor to see if you must pay any state minimum wage.

- You should check with your state to see if you must purchase workers' compensation insurance.

Other ways to leverage this opportunity

Maximizing your deductions during tax season isn't the only way to benefit. Certainly, it can go into your child’s savings account but since they are now employed, you could also put up to $6,000 a year in a Roth IRA. These funds will grow tax-free, and it creates an opportunity to build their future. It can be used for college, a home purchase, or even retirement.

Another option is placing the wages in a 529 savings plan to help with future education (or current education if your child goes to a private school). A 529 savings plan allows you to save money for expenses related to education. The money contributed to a 529 savings plan is invested and can continue to grow throughout the life of the investment.

When you use a Roth IRA account or a 529 savings plan, the capital gains are tax free. In other words, this money is always tax free from start to finish.

Lastly, as an added bonus, this may also get your child interested in money management at an earlier age!

Recap: employing your child the right way

Let’s review the steps you must take to properly employ your child:

- Prepare a job description and set a reasonable pay rate.

- Document the work.

- Have a place to put the money (an account in your child’s name).

- Fill out a W2 at the end of the year and be sure to have an EIN.

- Do your child’s taxes. You can use a free version of common tax preparation software for your child’s taxes because they are under the standard deduction.

By paying your children and deducting their wages as a business expense—and by keeping them from paying taxes if they stay under the standard deduction—you can take advantage of some big tax savings for your family.

Remember, if you want to be able to deduct the amounts you pay your children, you must follow the rules cited above. Although the process can feel intimidating, the tax benefits are real!

Disclaimer

The information contained here is for educational purposes only and is not intended to constitute legal, tax, or financial advice.