Child Care Provider Expansion Initiative

Spending Strategies for New Businesses

Introduction

Even before you open your child care business, you will have many expenses that you will need to pay for. You will need to consider the cost for licensing, materials, supplies, staffing (including staff training, marketing, equipment) and much more. This list doesn’t even include what you might need to pay for to secure your location and make sure that it is up to code and ready to serve young children.

The Child Care Provider Expansion Initiative is designed to help offset some of these expenses for programs that are just opening, or that are expanding to serve more children. Planning ahead and deciding where to spend your award funding and money from other sources can seem overwhelming, but it does not have to be. This guide will help you to navigate common costs associated with launching a new child care program and learn what expenses you can use the Child Care Provider Expansion awards on, and what you cannot.

How do I plan how to spend my funding?

Once you have determined to open new child care business, your first thought is likely about where you will find the money to open it. It’s best to have a realistic idea of your start-up costs and compare it to your anticipated funding for the business and understand if there are any gaps. Following these five basic steps will ensure that you are strategically using your funds in a plan that results in a successful startup:

- Step 1: Make a list of all of your costs

- Step 2: Make a list of all of your funding sources

- Step 3: Identify costs that are eligible for coverage by the Expansion Initiative

- Step 4: Match your costs and funding sources

- Step 5: Develop a plan for any additional funding needed

Step 1: Make a list of all of your costs

Your start-up budget should include a list of everything that you need to launch your new child care business. These costs will usually fall into these categories:

- Personnel (includes your staff wages, benefits, and payroll taxes. Could also include training expenses),

- Supplies (includes classroom, office, and general building supplies),

- Equipment (including classroom and office furniture, outdoor equipment, and technology),

- Construction or renovation costs,

- Operating costs (includes rent or mortgage, utilities, communications, and insurance),

- Marketing and advertising,

- Permitting fees, and

- Other/miscellaneous category.

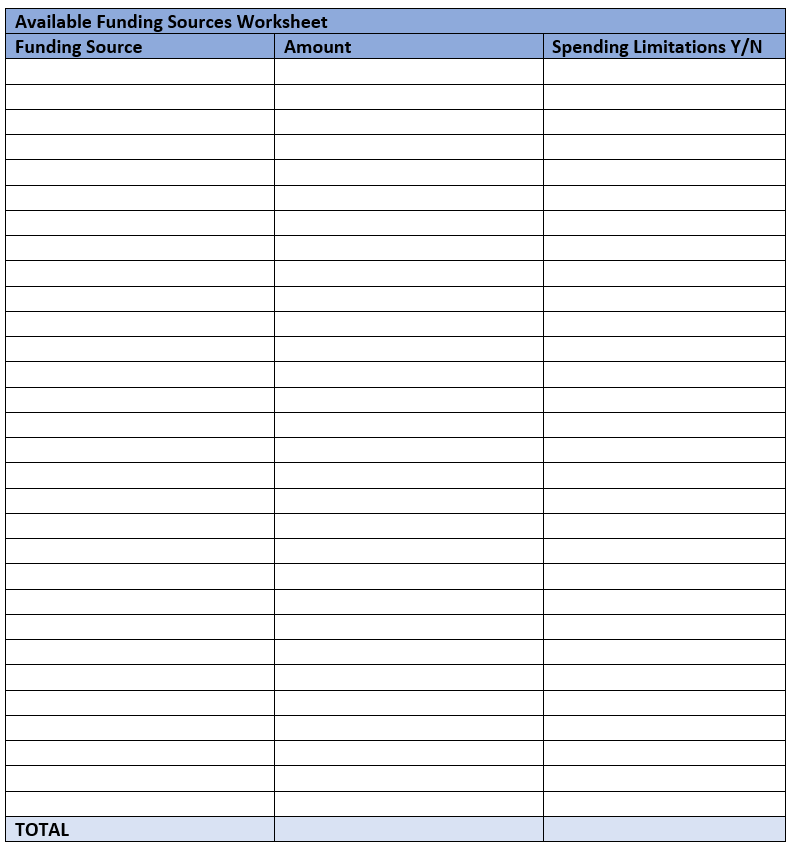

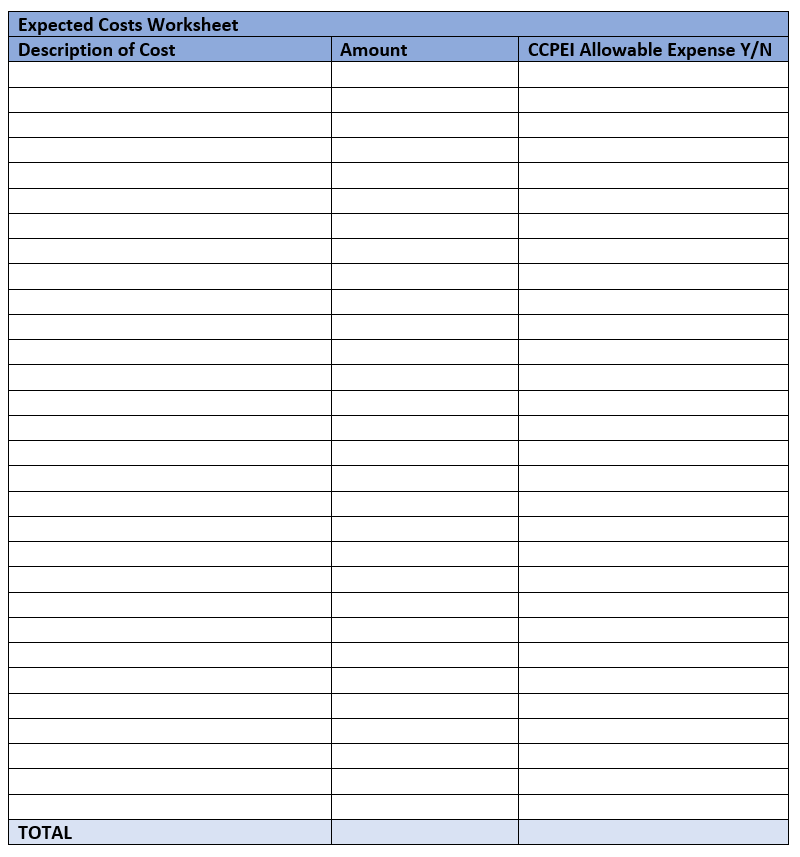

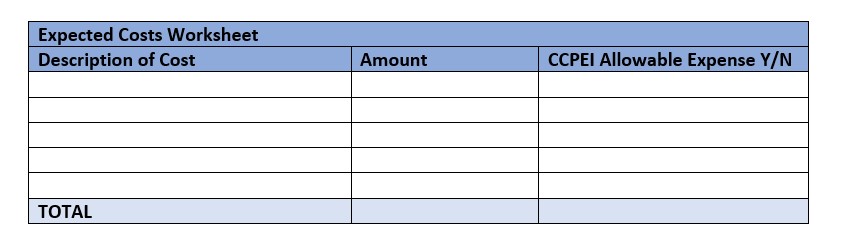

Think through your expansion or start up project and put together a list of all your anticipated expenses and cost estimates within these categories. Include as much detail as possible including how much you expect each part to cost you. You can find worksheets to help you start your list in Attachment A.

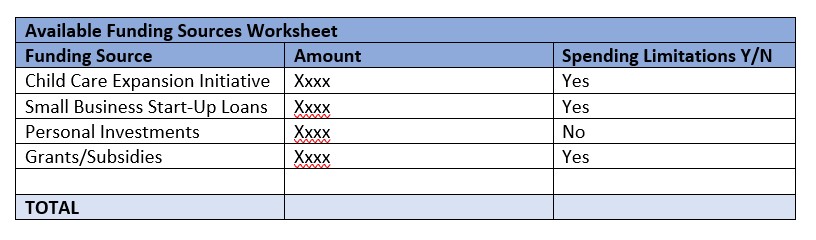

Step 2: Make a list of all of your funding sources

Most business startups will involve you spending money before you begin to bring in much revenue. Since you may not have any revenue to invest in your business, you will need to identify the sources that this initial funding will come from. The list of your funding sources will include sources that are already committed, pending, or anticipated, and how much each will contribute. For example, if you need financing for your startup, you will want to understand if those funds are already in process of being paid to you and/or what the likelihood of receiving them will be. Take a moment to list all your available funding sources and whether there are any restrictions on how you use those funds:

Step 3: Identify costs that are eligible for coverage by the Initiative

Now that you have identified your costs and funding sources, it is important to be strategic in how your funding will be allocated. Often, loans and awards (such as the Expansion Initiative) come with guidelines on how they can be used. It’s important to be aware of those guidelines and plan accordingly.

Here are some ways you can use your funds to support your business in the early months. Please note that there are limitations on how these funds can be spent and you will want to make sure that you are complying with the allowable expenses. You can learn more about how the funding can be spent by revisiting the Application Guide.

- Permitting fees – You can use these funds to help pay your Child Care Regulation permitting fees or other fees that you occur when beginning or expanding your business.

- Hiring and retaining staff – While these funds aren’t designed to be used as part of your regular payroll, you can use these funds to provide hiring bonuses or performance bonuses after a certain length of time to the staff you have or will hire. Hiring bonuses and performance bonuses can attract new employees to join your new business and encourage all employees to stay.

- Curriculum Supplies and Equipment – New or expanded child care businesses will need new materials. You can use these funds to purchase the items that your business will need. Some ideas include:

- Items for children: Learning materials and manipulatives, toys, books, blankets, baskets, etc.

- Items for staff members: Curriculum materials, assessment materials, training on how to use these systems, technology, resource materials, etc.

- Items for your program: appliances, cookware, serving utensils, bottle warmer, water filter, wet wipe warmer, replacing fire extinguishers or carbon monoxide detectors, etc.

- Items for your administrative use: technology, child care management system, software for communicating with families, door entry system, etc.

- Items for your outdoor play space: fencing, playground surfacing, equipment, shade structures, installing or updating sidewalks, balls, ride-on toys, storage for outdoor materials, etc.

- Business and Learning Space Furniture and Improvements – Your new or expanded business will need furniture for children and adults. Perhaps your space could use some repairs or enhancement, these are great uses of these funds. Some ideas include:

-

- Learning space furniture: bookshelves, tables, child-sized chairs, high chairs, cribs, cots, changing tables, cubbies, rugs, room dividers/gates for infants, etc.

- Business furniture: desk, tables, adult-sized chairs, bookshelf, technology, printer, office supplies, bulletin board, etc.

- Minor space improvements: exterior or interior painting, installing railings and ramps to increase accessibility, lighting, plumbing, or kitchen fixtures upgrade, trim work/minor carpentry, flooring replacement, HVAC replacement, security system, etc. (Please note that major renovations and construction are prohibited with these funds.)

- Marketing – Enrolling families and hiring staff will be critical to the success of your new or expanding child care business. Targeted marketing efforts can help new families and new staff learn of your program. Here are some ideas:

-

- Publishing flyers, hosting open houses, website development, quality photographs, etc.

- Subscription fees to share your child care program openings and/or job postings, etc.

Note which of your expenses cannot be covered with Expansion Initiative funding.

The Child Care Provider Expansion Initiative funds do have limits to how you can use them. Here are some things that you may NOT use these funds for:

- Property and liability insurance

- Taxes

- Tuition (covering fees for enrolled children)

- Major renovations and new construction

Major renovations are not allowable expenses for coverage with Expansion Initiative funding due to the federal source of funding for the program. Major renovation is defined as (1) structural changes to the foundation, roof, floor, exterior, or load-bearing walls of a facility, or the extension of a facility to increase its floor area; or (2) extensive alteration of a facility such as to significantly change its function and purpose, even if such renovation does not include any structural changes.

It is likely that you will have some building renovation needs. Just because you cannot use your Expansion Initiative award for these projects, that does not mean you cannot or should not make these building renovations. If you find that you need to pay for major building renovations or other costs that aren’t allowed by your award funds, we suggest that you pay for it out of your regular operating budget and then use your award funds for something on the approved list of allowable expenses. Look at your anticipated costs to see if the Child Care Provider Expansion Initiative Funding can be used toward the expense:

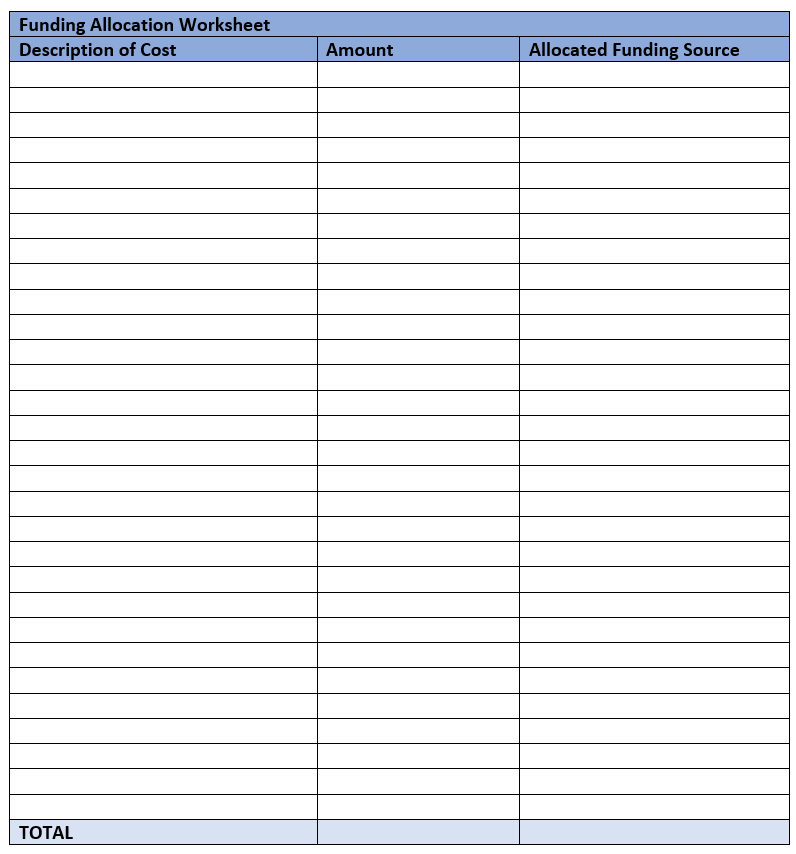

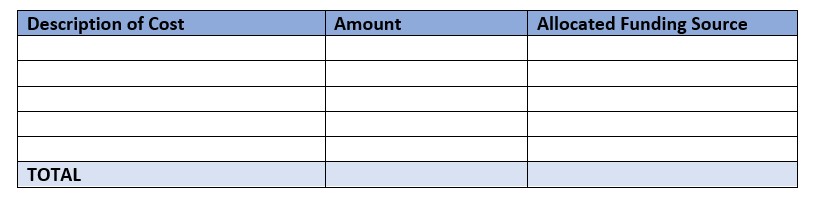

See Attachment A for funding and cost worksheets.

Step 4: Match your costs and funding sources

Now that you have identified all your expenses, your funding sources, and noted which costs can and cannot be covered by your Child Care Provider Expansion Initiative Funding, you can match your available funding to your anticipated costs. Set up a simple list or a table, like the one below (See Attachment A):

As you begin to assign a funding source to each anticipated cost, make sure that you prioritize figuring out how to pay for any of your costs that have restrictions on how they can be paid for. For example, if you have built up your own savings to cover payroll costs before you have children enrolled, but don’t have any other funding available to cover your construction costs, you might want to reconsider how you are using your funding. Remember that you won’t be able to use Initiative funding toward your construction. Instead of using your own savings on something that you can use Expansion Initiative funding for too, you could use your savings to cover your construction costs and use Initiative funding toward your payroll costs. This way, you have money to cover both expenses.

How do you determine prioritize how you should spend these funds?

Look at any barriers that you have to opening a child care program or expanding and then prioritize those areas with your funding. If you have areas that need to be updated due to a safety concern, such as your kitchen area, fire suppression system, fencing, and/or security needs, then prioritize that safety area for your award funds.

Additionally, one way to prioritize your award funding is to look at your larger expenses. Payroll is usually the biggest expense a center has – and for a home, it could be your ongoing rent or mortgage and utilities payments. Using your Expansion Initiative larger allowable expenses allows you to efficiently and effectively utilize all your available funding sources and makes the monitoring and reporting process much easier, as you will have less receipts.

Know the limits on how the funding can be spent

Be sure to refer to the Expansion Application Guide if you have questions about how you want to use the funds. Remember, if you have an expense that is not allowed under the funding award agreement, you can still purchase the item with funds from your business’ budget and use the funds from the award toward something allowable already in your business’ budget.

As a reminder, funding cannot be used for:

- New construction or major renovation: The federal source of the funding for this initiative prohibits using this award for construction or major renovations, or the purchase or improvement of land. Major renovation is defined as: (1) structural changes to the foundation, roof, floor, exterior or load-bearing walls of a facility, or the extension of a facility to increase its floor area; or (2) extensive alteration of a facility such as to significantly change its function and purpose, even if such renovation does not include any structural change.

- Costs to support property occupancy other than monthly payments: Down payments, security deposits, and other one-time payments associated with entering a lease or purchasing property are not allowable. Also, funds cannot be used to contribute to mortgage loans in excess of the payment requested by the lender.

- Paying yourself through owner draws: Owner draws or other methods of taking a capital gain are not considered allowable expenses under the Child Care Provider Expansion Initiative. Owners’ documented wages are allowable. To learn more about how to pay yourself, see the guide on childcare.texas.gov.

- Franchise fees or other franchise royalties are not allowable expenses.

- Expenses paid for by another stimulus, relief funding program, or other public funding source (e.g. Child Care Relief Fund)

Step 5: Develop a plan for any additional funding needed

Once you have completed allocating your available funding toward your anticipated costs, you may find yourself in a situation where you still need additional funding. There are a couple of tasks that you can take to make a plan to effectively fund your expansion project.

- Revisit your pricing: Ensure your pricing (tuition) is accurate and up to date. Oftentimes, child care businesses underprice their services in efforts to increase access to care or aim towards fuller enrollment. However, as a business, it is important to ensure that your pricing accurately reflects the needs of your business and sets you up for financial success. To learn more about pricing, see our guide.

- Trim your costs: Are all your expenses necessary? Look at your budget and see if there is any trimming or postponing that can be done. Look at recurring costs like subscriptions or items that you can put on a list of future goals. Don’t forget to look at automation options that can help you to better manage your time.

- Explore loan options: Taking out a loan is a big responsibility. However, sometimes the benefits will outweigh the risks of taking on additional debt. Learn how to understand when a loan is a wise choice for your business in our online guide.

Need Help?

To learn more about the Child Care Provider Expansion Initiative, visit https://www.childcare.texas.gov/childcare-expansion. Please email expansion@civstrat.com with any questions.

Additional Resources

How can I create an effective sales and marketing plan?

Can I get a loan to support my business?

Attachment A

Funding and Cost Worksheets